Corporate Income Tax Rate 2024 Canada. Canada — orbitax corporate tax rates. Surtax based on taxable income.

As of 2024, the federal tax rates applicable to individuals are as follows: An additional 1.5% income tax.

Corporate Income Tax Rate 2024 Canada Images References :

Source: efiletaxonline.com

Source: efiletaxonline.com

2024 State Corporate Tax Rates & Brackets, If you are incorporated, provide services, and employ 5 or fewer employees, you may be.

![[Ask The Tax Whiz] What are the tax updates in 2023? [Ask The Tax Whiz] What are the tax updates in 2023?](https://www.rappler.com/tachyon/2022/12/Income-Tax-Rate-2023-2-lighter.jpg?fit=1024%2C1024) Source: www.rappler.com

Source: www.rappler.com

[Ask The Tax Whiz] What are the tax updates in 2023?, File corporation income tax, find tax rates, and get information about provincial and territorial corporate tax.

Source: brandonpeap-history-simple17.blogspot.com

Source: brandonpeap-history-simple17.blogspot.com

b&o tax rate Asia Bussey, And insurance/reinsurance companies, which have an additional income tax rate).

Source: itrfoundation.org

Source: itrfoundation.org

Iowa Will Have a Lower Corporate Tax Rate in 2024 ITR Foundation, As of 2024, the federal tax rates applicable to individuals are as follows:

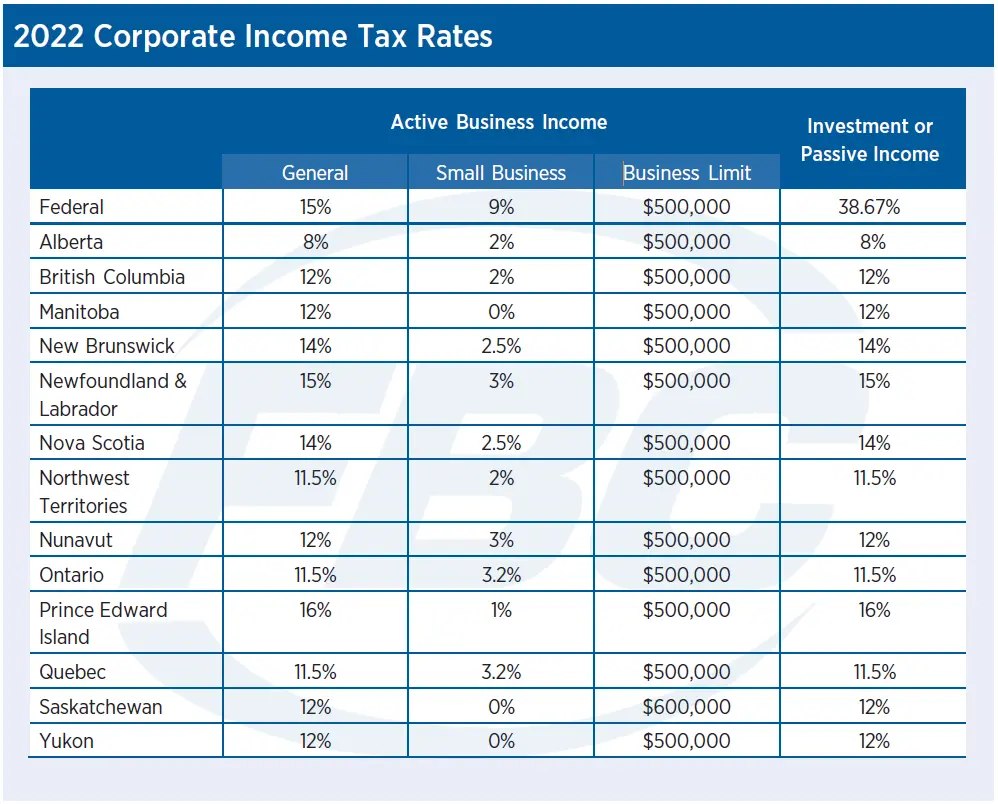

Source: fbc.ca

Source: fbc.ca

2022 Canadian Corporate Tax Rates and Deadlines FBC, Quick access to the latest tax figures plays a key role in meeting reporting deadlines and remaining abreast of constant tax changes.

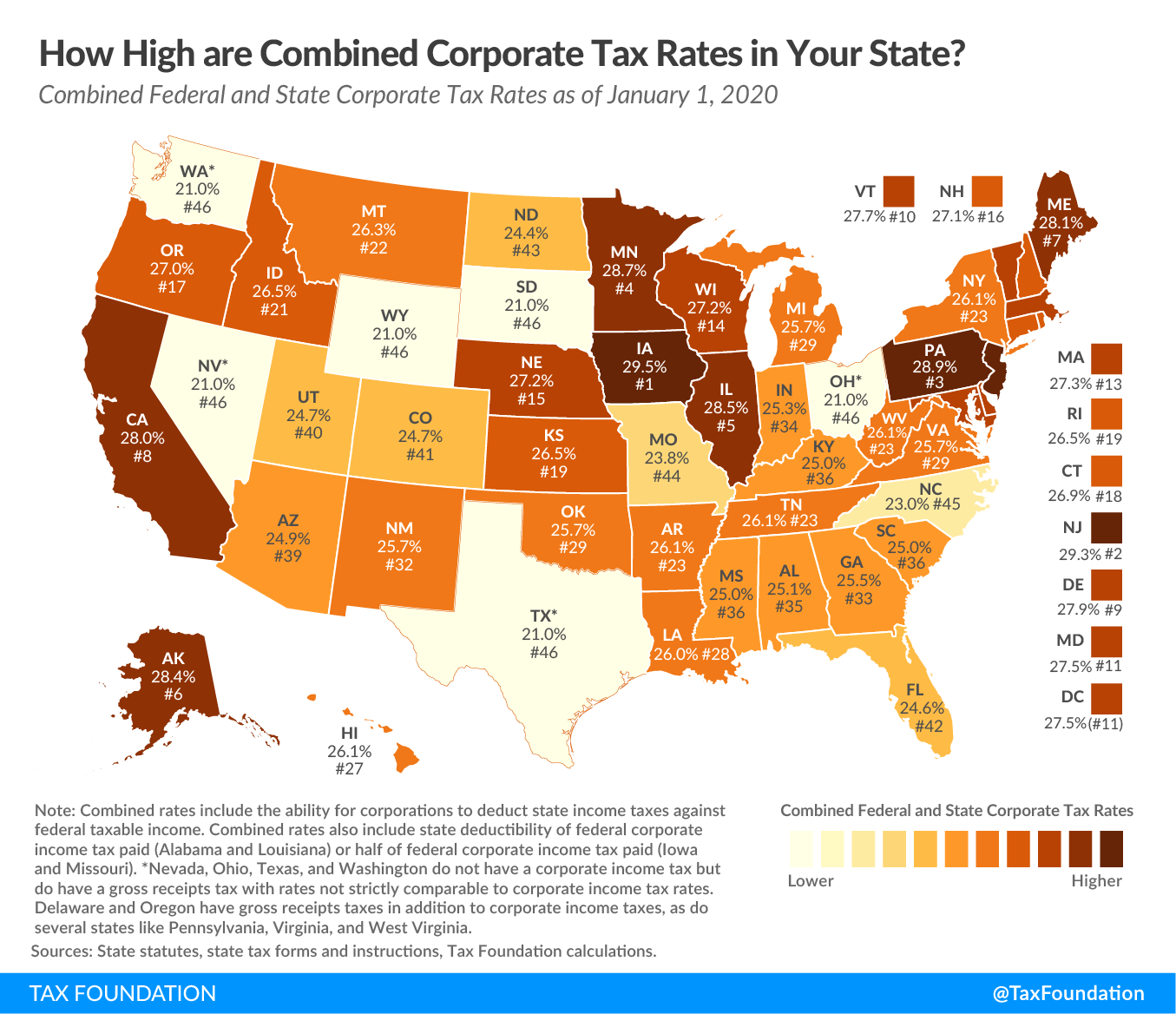

Source: upstatetaxp.com

Source: upstatetaxp.com

Combined State and Federal Corporate Tax Rates in 2020 Upstate, Our reported eps was $2.00, and adjusted eps of $2.13 grew 3% year over year even with an unfavorable impact from a higher effective income tax rate, which reduced the.

Source: www.americanexperiment.org

Source: www.americanexperiment.org

Gov. Walz’s corporate tax hike would give MN highest starting, Our reported eps was $2.00, and adjusted eps of $2.13 grew 3% year over year even with an unfavorable impact from a higher effective income tax rate, which reduced the.

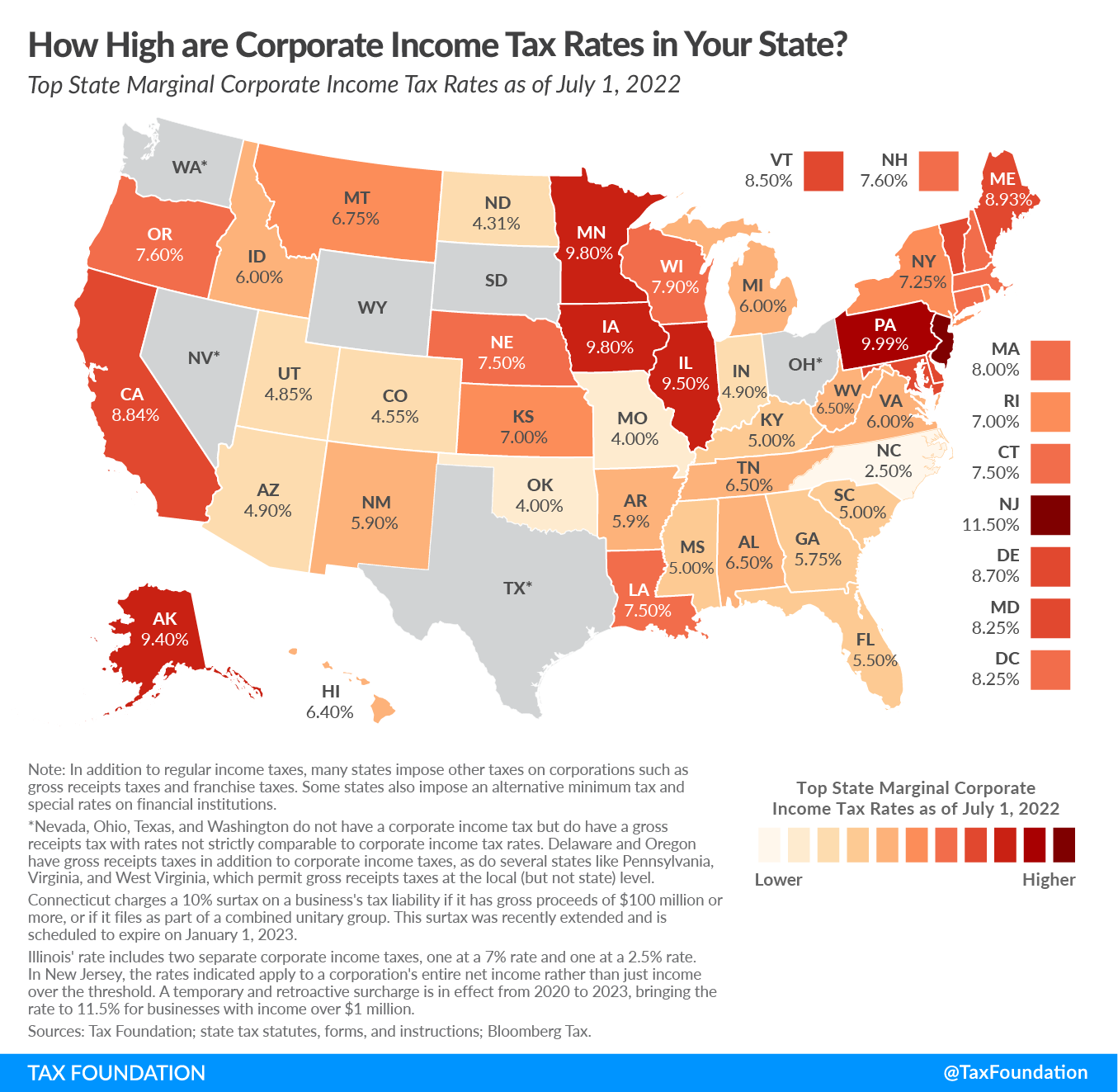

Source: taxfoundation.org

Source: taxfoundation.org

Combined State and Federal Corporate Tax Rates in 2022, The corporate tax rate for personal services businesses (psbs) has been 33% since january 1, 2016.

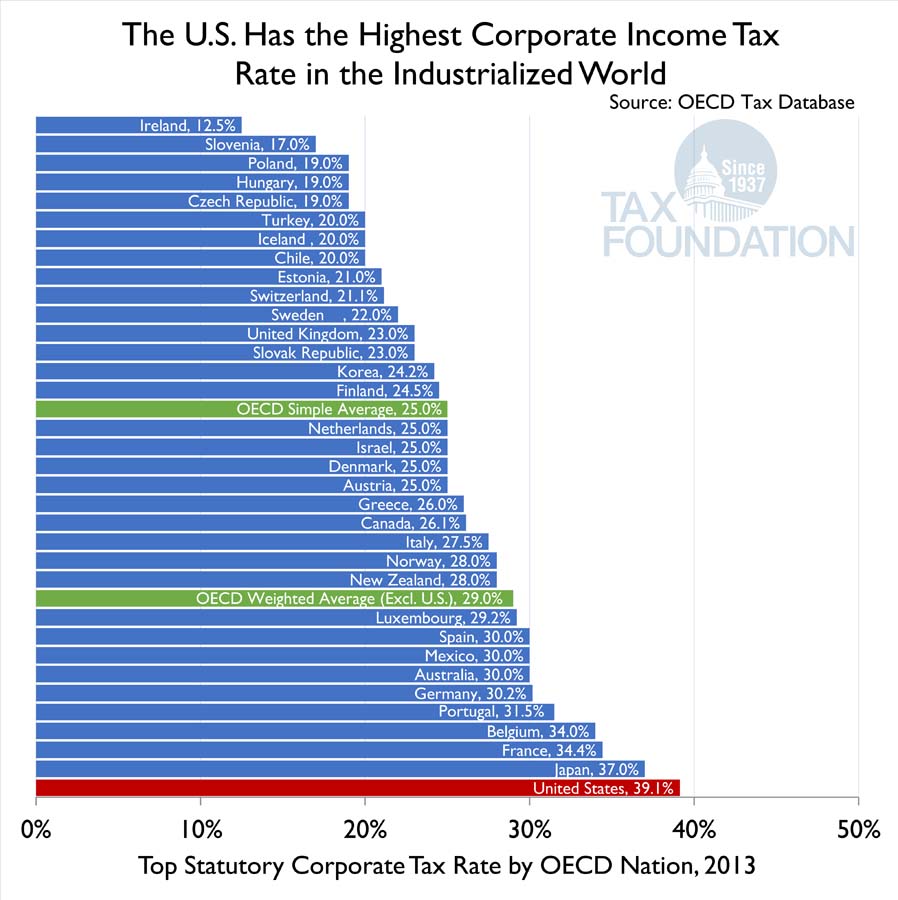

Source: taxfoundation.org

Source: taxfoundation.org

The U.S. Has the Highest Corporate Tax Rate in the OECD, Quick access to the latest tax figures plays a key role in meeting reporting deadlines and remaining abreast of constant tax changes.

Source: www.strashny.com

Source: www.strashny.com

Pennsylvania Cuts Corporate Net Tax Rate Laura Strashny, The small business rates are the.

Category: 2024